The theory of employment developed by the classical economist is called the classical theory of employment. For this theory, French economist J.B. Say formulated a law which is known as the "Say's Law of Market". Classical economists such as J.S. Mill, Marshall, Pigou, etc. have supported this law of J.B. Say.

Classical economist assumed full employment in the free market economic system. According to their views, under perfect competition, unemployment will be temporary and after some time it will disappear. Even at times, if full employment is not realized, then this will gradually move towards full employment. But for the realization of full employment, there should not be government intervention, monopoly market as well as labor unions. Therefore, this theory is based on the assumption of perfect competition, free and autonomous market. This situation of full employment in the economy has been taken at the general phenomenon by the classical economist.

Assumptions of Classical Theory of Employment

The classical theory of employment is based on the following assumptions:- There is an existence of a free market economy.

- Classical Theory of Employment.

- There is the presence of self-adjusting economy.

- There is the presence of a closed economy which means international trade.

- Individuals do not suffer from money illusion.

- Money is only a medium of exchange.

- Wages and prices are flexible both upward and downward.

- The technique of production and business organizations do not change.

- The labors are homogeneous.

- There is full employment in the economy.

The classical economist believed in the suitable equilibrium at full employment level as a normal situation. If there is not full employment in the actual life, then there is always a tendency towards full employment. Less than full employment is an abnormal situation which will disappear in the long run through the automatic mechanism of the economic system. Other important assumptions are flexibility, wages, interest, and prices. This means the wage rate, interest and price level change in their respective markets according to the forces of demand and supply. Any change in these variables automatically adjusts the economic system in such a way that ensures full employment. Thus, the working of the self-regulating mechanism under the classical system can be understood in the three market of economy i.e. Labour market, Product market and Money market.

Labour Market

According to the classical theory of employment equilibrium level. If there exists some unemployment, the labor will compete for jobs and the real wage rate will fall. A fall in wage rate will lead to an increase in demand for labor and a decrease in the supply of labor. This will remove unemployment. Thus, the flexibility of wage rate insures full employment.According to the classical theory, unemployment is the result of the rigidity of wage structure and the interference in the automatic working of the labor market. When government interferes by recognizing trade unions, passing minimum wage legislation, etc, the labor adopts monopolistic behavior, wages are pushed up which leads to unemployment. Only the flexibility of wage, under the condition of perfect competition, can ensure full employment. This concept can be clearly explained by the help of the figure below:

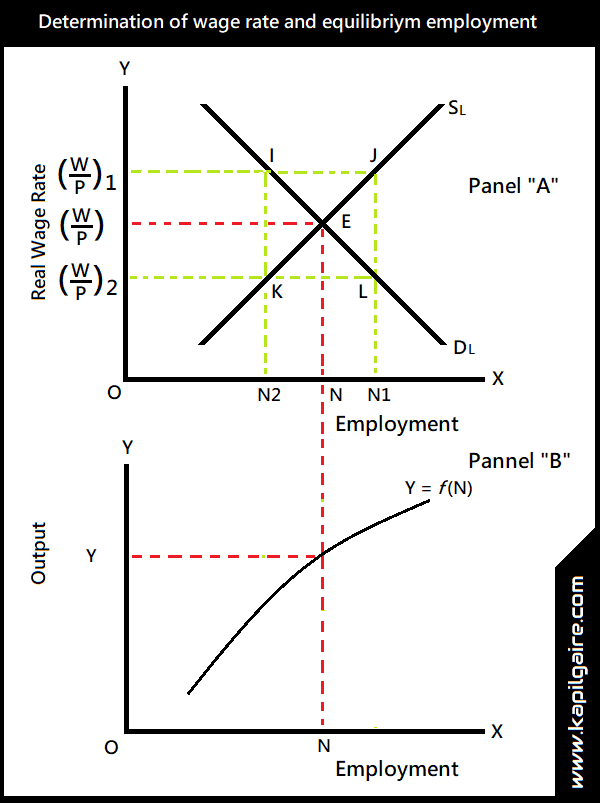

In the figure above, Panel "A", DL is the aggregate demand curve for labor curve and SL represents the aggregate supply curve of labor. These two curves are intersecting each other at point E determining equilibrium wage rate (W/P) at full employment level ON. If real wage is maintained at a higher level (W/P)1, the supply of labor will exceed the demand for labor by IJ (N1N2) which indicates the amount of unemployment. Labor market being competitive, unemployment of labor will reduce wage rate to the original equilibrium level (W/P). This will remove unemployment and economy will achieve full employment level at ON. On the other hand, if the real wage rate is maintained at a lower level (W/P)2, demand for labor will exceed the supply of labor by KL, which indicates a shortage of labor. The competition among the employer to hire labor will push wage rate to the original equilibrium level (W/P). Hence, through the flexibility of wages, full employment is created in the labor market at ON.

In the above figure, Panel "B", Y= f(N) curve represents total production function. At full employment level, ON, the corresponding full employment output is OY. The full employment level output of the economy depends upon the nature of the technology. Total output is a function of the number of workers employed (N). The classical economist assumes the operation of the law of diminishing returns.

Product Market

According to Say's law, full employment is maintained only when whole income generated at full employment level is spent on the purchase of the whole of the output. That means part of income which is not consumed or saved must be spent on Investment goods. It is shown by following algebraic expression:

Total Income = Total Output

Or, C+S = C+I

Or, S = I

Where,

C= Consumption

S= Savings

I= Investments

Thus, Equality in saving and investment results market clearing condition in the product market at full employment level. It assures whole of the full employment output in the product market will be purchased. In other words, if savings of household is equal to investment, there will be no problem of unemployment, overproduction, and underproduction.

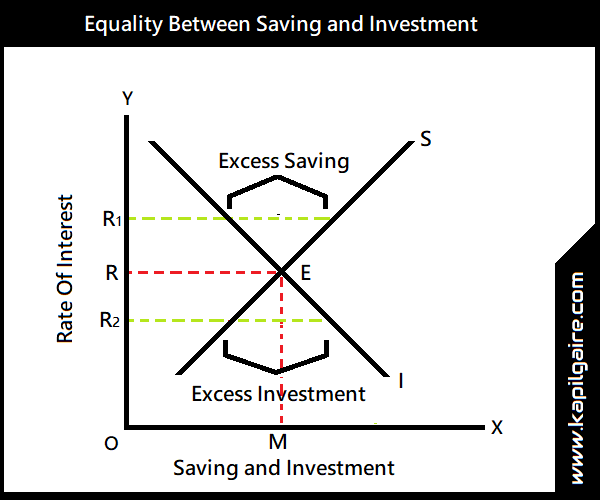

According to the classical economy, equality between saving and investment is determined by the interest rate flexibility. Saving is a positive function of the rate of interest and investment is the negative function of the rate of interest. Equilibrium rate of interest is determined when saving and investment is equal. If savings (investment) exceeds investment (saving), the rate of interest will fall (rise). This discourages saving (investment) and encourage investment (saving), thus making saving and investment equal again. It is shown in the figure below:

In the above figure, X-axis represents saving and investment and Y-axis represents the rate of interest. The downward sloping curve (I) represents an investment and upward sloping curve (S) represents savings. E is the equilibrium point. If the rate of interest is above equilibrium level there will be excess saving and cause fall in interest rates from OR1 to OR. Again, when interest rates fall below equilibrium level, there will be the excess investment and cause the rise in interest rate OR2 to OR.

Money Market

The classical economists believe in the quantity theory of money which states, the supply of money determines price level in the economy.

Irving Fisher's equation of exchange states that total expenditure on final goods and services (MV) is equal to the total value of output (PY).

MV = PY

Or, P = MV/Y

Where,

P= Price level

M= Quantity of money

Y= Level of output / total volume of transaction

V= Income velocity of circulation of money

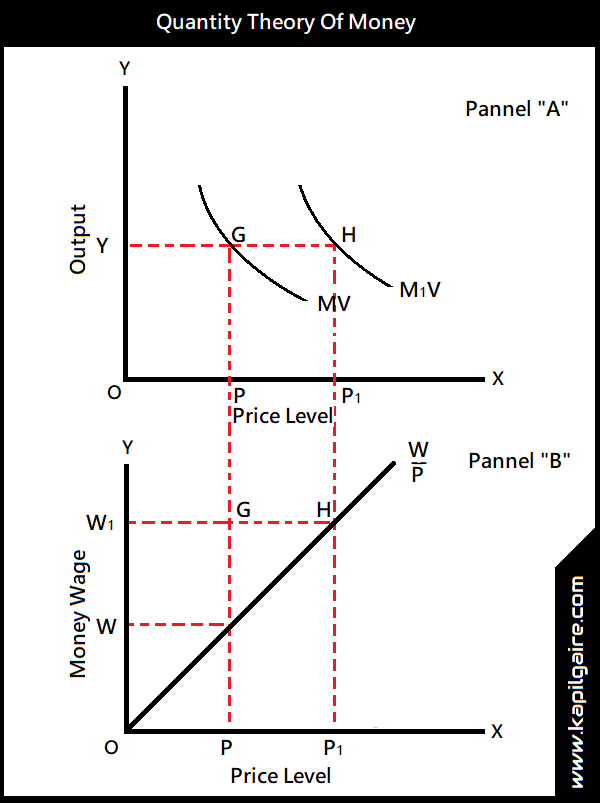

According to classical economists, level of aggregate output (Y) remains constant at full employment level. They also assumed income velocity of circulation of money (V) remains constant or stable. Thus, Y and V are constant, the level of price is determined by the quantity of money (M) and there is a direct relationship between M and P. It means that the changes in the money supply lead to proportional changes in the price level. It is explained with the help of the figure below:

In Panel "A" of the figure, X-axis represents price level and Y-axis represents output. MV curve is the initial money supply curve which also represents the demand for goods. It is rectangular hyperbola because the equation MV=PY holds true on all points of the curve. At full employment level of output OY, the corresponding price level is OP. When the supply of money increase from MV to M1V at constant full employment output OY, there will be a proportional increase in the price level from OP to OP1

In Panel "B" of the figure, It explains the determination of money wage consistent with a given (W/P) is the real wage line. At price level is OP, money wage is OW. When price level OP rises to OP1, money wage will also rise from OW to OW1. The price and wage combination OP1=OW1 is consistent with the full employment real wage level (W/P), as determined in the labor market.

Criticism of Classical Theory of Employment

The classical theory of employment has been criticized on the following grounds:

1. Supply does not create its own demand:

J.B. Say states that supply creates its own demand. But, according to Keynes, when income increases, a part of it is consumed and remaining is saved. There is no guarantee that the savings will be invested in investment goods. Thus, if the investment does not increase with increases in employment, there will be a deficiency of demand. Hence, supply does not create its own demand.

2. Role of Money:

Say's law assumes that money is only a medium of exchange and there is no store of value function of money. But Keynes says that money also functions as the store of value. People also demand money for the speculative purpose to take benefit of the rise in interest rate in the future. Hence, money is not only a medium of exchange.

3. The economy is not self-adjusting:

According to J.B Say, the economy is auto-adjusting and should not be intervened. But Keynes reject this theory mentioning three reasons:

a. When liquidity preference schedule becomes perfectly elastic,

b. When investment function becomes interest inelastic,

c. When due to money illusion, money wages becomes rigid downwards.

4. Government intervention:

The classical economist, economy is auto adjusting and there should not be any government intervention. But Keynes recommend government intervention is necessary to regulate and save the economy from uncertainties.

5. Concept full employment equilibrium:

According to classical economists, there is full employment and involuntary unemployment is impossible. They also mention that wage flexibility always tends to full employment equilibrium. But, Keynes has shown that there is the possibility of underemployment, full employment is almost impossible. The concept of full employment is not a normal phenomenon in the real capitalist economy.

6. Saving-Investment equality:

According to the classical economists, saving and investment are equal and it is determined by interest rates. But, according to Keynes, income makes saving and investment equal not because of the rate of interest. When saving exceeds investment, aggregate demand decreases and income level also decline which results in a fall in savings. As a result of a fall in saving, investment and saving become equal. And when investment exceeds saving, income rises, saving increases and becomes equal to investment.

7. The assumption of perfect competition:

The classical theory of employment is based on the assumption of perfect competition which is unrealistic and does not exist in the real world.

8. Not practical:

The classical theory is not practical in the real capitalist market. It does not provide any solution to the problem of unemployment and trade cycle.

Conclusion

Though the classical theory is perfectly logical in its content, it has a little practical significance. It cannot be applied to solve the actual problems of the world.